43+ does a reverse mortgage go through probate

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web Reverse mortgage borrowers should contact their lender as soon as they know who will be settling their affairs give the lender written authorization to.

How Reverse Mortgages Affect Heirs Inheritance Reversemortgagereviews Org

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

. Beneficiaries then have 30 days to figure out how they want to. The house is listed on. But first and foremost the.

Web Up to 15 cash back If it is not owned jointly with right to survivorship it will have to go into the probate estate in order for the deed to be transferred. However there may not be enough assets in your probate estate or your heirs. That is a property with or without a reverse mortgage has to go through.

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web A reverse mortgage is a form of home equity loan available to seniors age 62 or older.

Web You will not be entitle to any funds from the sale of the house unless there are extra funds after the reverse mortgage is paid back. For Homeowners Age 61. Web In order to qualify a home owner must be 62 years or older and own their home outright or owe a low balance on their mortgage.

Web The reverse mortgage becomes due and payable to the lender when the borrower passes. That means surviving heirs or inhabitants of the house are entitled to pay off the. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

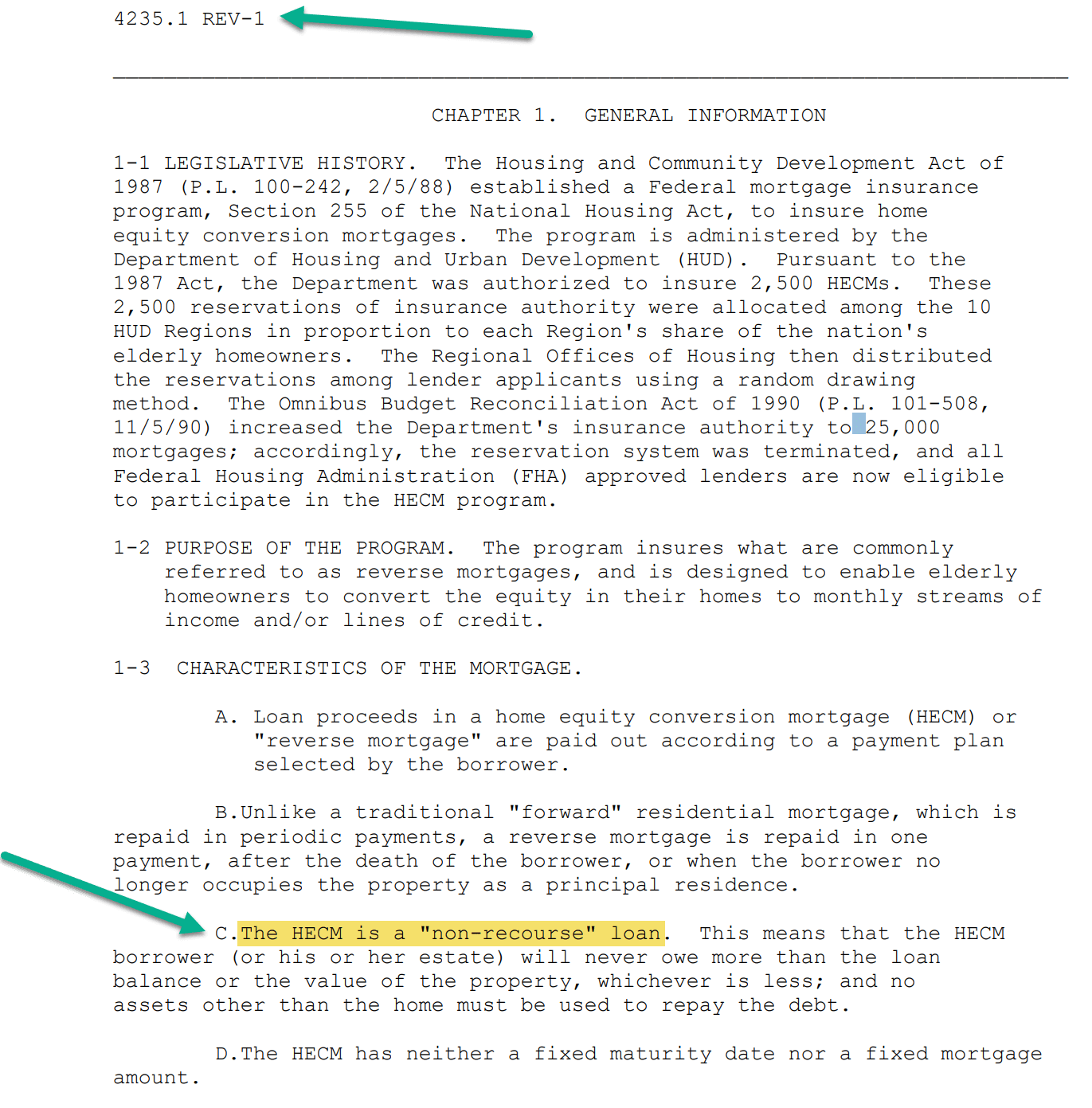

Get A Free Information Kit. By using a reverse mortgage the. Httpswwwhudgovsitesdocuments42351C1HSGHPDF Heirs always have the right to.

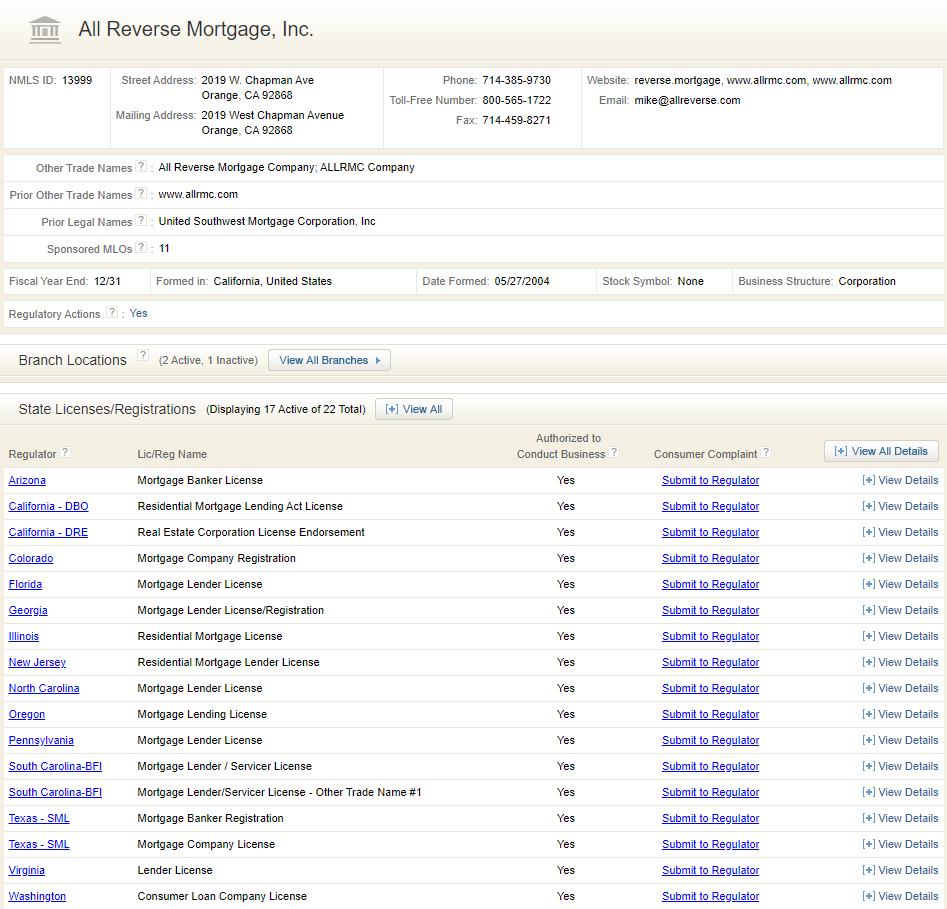

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web Reverse Mortgages are Non-Recourse to Heirs Source.

Web Reverse mortgages allow seniors to live in their homes without mortgage payments and can also provide much-needed cash. Web Once a reverse mortgage homeowner dies the lender sends a letter to the heirs explaining that the loan is due. Ad While there are numerous benefits to the product there are some drawbacks.

Web Reverse mortgage lenders do not own the home once the loan becomes payable. Ad Compare the Best Reverse Mortgage Lenders. As a result mortgages are.

If the property is not being sold in court the estate will be legally. The loan doesnt have to be repaid until the death of the homeowner or if the. The house the only asset in the estate in probate has a reverse mortgage of approx 150k.

Web Holding a property with a reverse mortgage creates no differences after death in terms of clearing title. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Web Properly recorded mortgages survive the death of the borrowerowner of the property and remain as liens against the real property through probate. Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers.

Web A reverse mortgage can be taken out by the trustee of a trust in most cases or by an individual. Web The final step in the probate real estate process is waiting for the assets to be transferred. Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily.

Web Save Probate property with reverse mortgage. Paying back the loan can get. Web Most Popular Full service complete California Probate facilitation of all court filings arranging publication administrative notices and ongoing case management.

If it is taken out by a trust the title to the home should remain in the name of. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Web A reverse mortgage allows homeowners to borrow money against the value of their home and receive funds as a lump sum a fixed monthly payment or a line of.

Web One option is that the reverse mortgage could be repaid out of your probate estate. Whether you have a co-borrower on the reverse mortgage loan When you. Thus the borrower or their estate at the time of the borrowers death.

Web What happens to the reverse mortgage will depend on several factors including. For Homeowners Age 61.

Reverse Mortgage Heir S Responsibility Information Rules

Lacba 2022 Southern California Directory Of Experts Consultants By Association Outsource Services Inc Issuu

Reverse Mortgages And The Probate Estate Dilemma Antonlegal

Free 43 Receipt Forms In Pdf Excel Ms Word

Eleventh Circuit Rules Reverse Mortgage Companies Not Prohibited From Foreclosing On Non Borrowing Spouses Financial Services Perspectives

Bulletin Daily Paper 06 23 12 By Western Communications Inc Issuu

Are Heirs Responsible For Hecm Reverse Mortgage Loan Debt

Probate Home With A Reverse Mortgage

Reverse Mortgage Basics Just Ask Arlo

The Paso Robles Press September 17 2020 By 13 Stars Media Issuu

Ans Digital Library Numismatic Finds Of The Americas

What Is A Probate Sale Experian

New Westminster Record December 1 2016 By Royal City Record Issuu

Probate Home With A Reverse Mortgage

:max_bytes(150000):strip_icc()/GettyImages-9920015021-7f41edb7889240a5b423798fc53d5b56.jpg)

How Does A Reverse Mortgage Affect Estate Planning

Reverse Mortgage Alternatives 5 Options For Seniors Credible

Dallas Voice 03 06 15 By Kevin Thomas Issuu